Ytech has plans for a major development after purchasing a property in Miami’s Brickell neighborhood for $12.2 million. The Miami-based developer, led by CEO Yamal Yidios, purchased full control of the 16,000-square-foot site at 41 and 75 S.W. 15th Road. The height could be up to 80 stories.

An affiliate of Trammell Crow Residential and the Carlyle Group purchased a former Costco store in the Fontainebleau area of Miami-Dade County to redevelop the site into apartments. The project was approved for 356 apartments in 350,341 square feet. The four-story buildings would be surrounded by 591 parking spaces, a clubhouse, and a pool.

The DeMarco Real Estate Group has successfully closed the sale of the 6596 Taft Street Hollywood FL 33020. Broker/Owner, John Demarco, represented the seller for this transaction. The property sold for $650,000

The DeMarco Real Estate Group is proud to announce the closed sale of 4861 SW 66th Ave. Davie FL & 6810 SW 7th Ave. Margate FL. The two ALF totaled 131 beds. Broker/Owner, John Demarco, and Senior Commercial Agent, Wesley Suskind represented both the seller and buyer for this transaction. The selling price was $7.2 million.

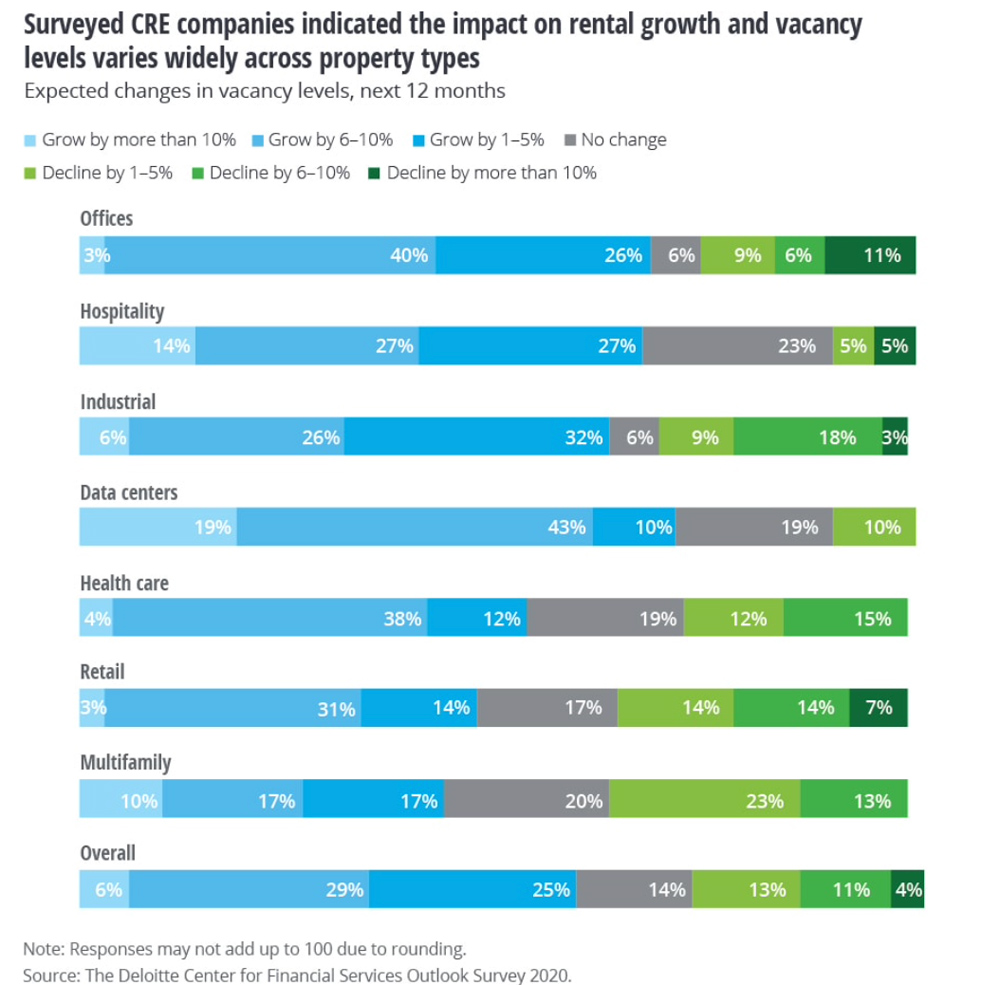

2021 Impacts on Rental Growth & Vacancy

Vacancy rates for affordable multifamily housing will remain relatively low in 2021. More affordable housing inventory (Class B and C) maintained low vacancy rates and modest rent growth in 2020.

Class A assets were impacted the most by COVID-19 this year due to higher turnover from some adults moving back home with their parents, steady delivery of new supply, and renters seeking less expensive housing.

Class B assets should continue to outperform in 2021 with low vacancy and steady rent growth. Class A assets may not begin recovering until midyear 2021.

Development projects will remain robust next year. Most of 2021’s scheduled deliveries were started long before COVID-19 and likely will reach 280,000 units on top of the estimated 300,000-unit total this year. This level of new supply will temper improvement in Class A vacancies and rents in many markets.

The chart above is data compiled from surveying top Commercial Real Estate Companies on what is expected with the vacancy and rental growth within 2021.

*Globally, 40% of respondents expect a decline in rental growth and 59% anticipate an increase in vacancy rates over the next 12 months.

*North American respondents’ expectations are balanced: 47% expect a rental decline and 49% anticipate an increase in vacancy levels (see graph above).

Featured Properties

Hollywood FL 33020

*8,000 SqFt

*Available for Lease

Hollywood FL

*10,378 SqFt

*Available for Lease