Commercial Real Estate Deals In South Florida

JLL has just arranged the sale of Cypress Financial Center, the property is selling at $44.2 million-the property consists of a 201,305square-foot office tower in Fort Lauderdale. The property is currently90% leased to a tenant roster that includes anchor Hayes Medical Staffing.

The DeMarco Real Estate Group has successfully listed and closed the sale of the 5614 Dawson Street, Hollywood FL. Broker/Owner, John Demarco, represented the seller and the buyer for this transaction. The property sold for $400,000 or $178 per square foot.

The DeMarco Real Estate Group has successfully closed the sale of the 6596Taft Street Hollywood FL 33020.Broker/Owner, John Demarco, represented the seller for this transaction. The property sold for$650,000. It was listed and sold in 5days.

Avison Young has contracted the $14million sale of Le Jeune Station, a three-acre development site in Miami. The sale site’s 10-parcelfootprint at 4238-42 NW 7th Street represents a mixed-use development opportunity which allows a total density of more than 260 units, and up to 300 units.

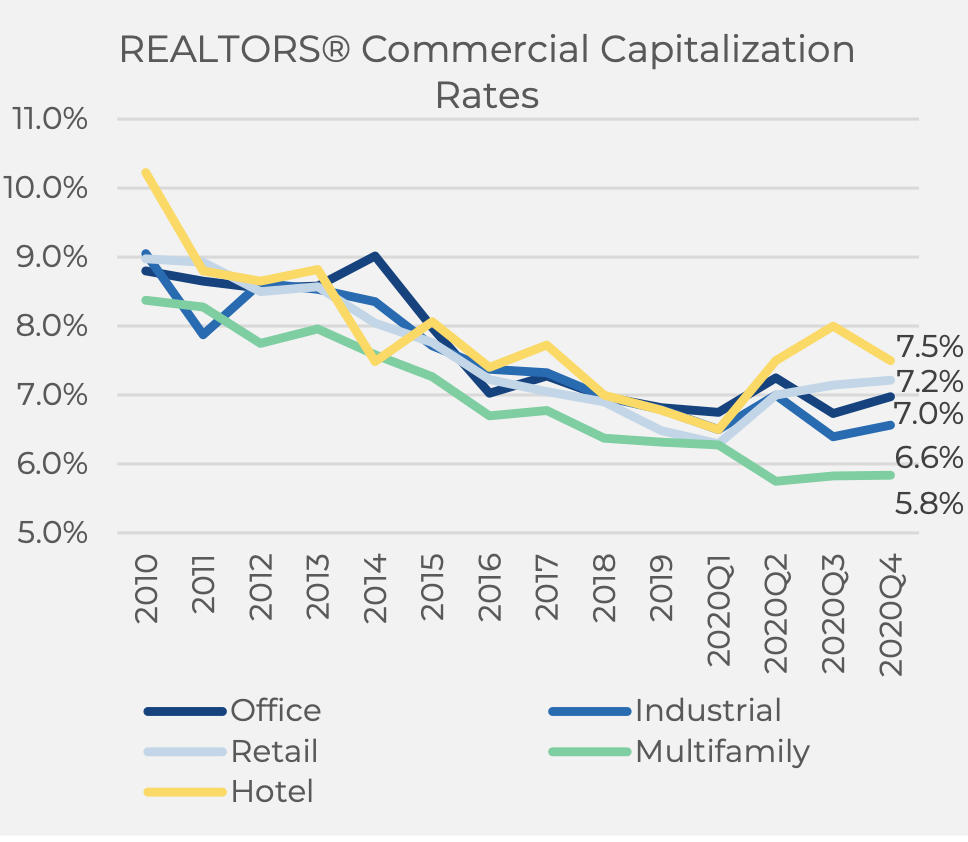

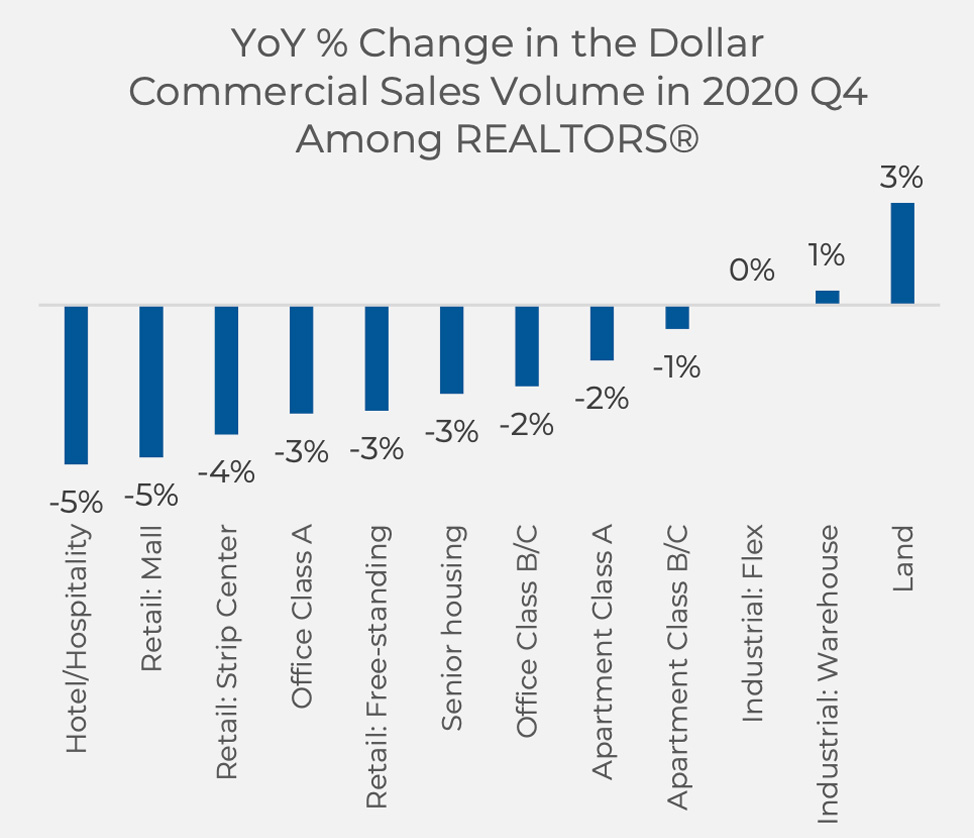

REALTORS® 2020 Q4 & 2021 Q1Analysis and CRE Insights

REALTORS® released figures and analysis on the commercial real market for the last quarter of 2020 and the first quarter of 2021. Below are the highlights and insights on the released report.

For the first quarter of 202 expectations are for an increase in sales of land(5% y/y), industrial (3% y/y), and multifamily (2% y/y) properties. REALTORS® reported that commercial sales prices in their markets were down on average by 1% in the fourth quarter on a year-over-year basis.

Apartment class A acquisitions had the lowest going-in cap rate (or lowest risk) among commercial assets, at 5.4%. Hotel/hospitality, retail, and office Class B had going-in cap rates of over 7%. (See graph above)

Regarding the land market, the properties with the strongest expected increase in sales are residential land (7% y/y), industrial land (5% y/y), and ranch lands (5% y/y). (See graph below)

REALTORS® also reported higher property values for apartments (1%),industrial assets (2%), and land (4%).

REALTORS® reported higher prices for all types of land, with the largest price increase in ranch land, industrial, and residential land, an indication of the strong demand for land outside urban areas since the COVID-19pandemic.

Among land transactions, the largest gains were in sales of recreational land(e.g. for camping), ranches, and residential land. This could be related to increased interest in land outside urban centers in the wake of the COVID-19pandemic.

Featured Properties

Hollywood FL 33020

*Restaurant*

8,000 SqFt

*Selling price $3,400,000

Fort Lauderdale FL

*Office Building*

9,619 SqFt

*Selling price $1,997,000*

Available for Lease